McAvoy Group has emerged as one of the leading offsite specialists, as clients warm to its manufacturer-contractor business model. CEO Eugene Lynch and managing director Mark Lowry explain their strategy to Will Mann. Pictures by Paul Lindsay

"Double digits certainly." That's the answer from McAvoy Group CEO Eugene Lynch and managing director Mark Lowry, when asked what margin is reasonable for a modular manufacturer which also acts as a principal contractor.

"We've invested in our product, in the R&D, and we have to carry significant overhead, with the factory, so certainly that margin is our ambition," adds Lowry. "But we have to be competitive and prove the benefits of our products."

McAvoy has been on a "journey" over the past eight years, as Lynch puts it, from being a modular supplier, to now acting as principal contractor on around 95% of its work. Its product has advanced and client uptake increased, fuelled in part by digital technology. At a time when leading industry figures like Mark Farmer are forecasting disruption to the traditional tier 1 contracting model, McAvoy looks well placed to capitalise.

The Northern Ireland-based group, which dates back to 1972, has the ambition. Turnover has doubled to £70m in the last five years, with plans to grow to £150m over the next five.

"This is the third coming of offsite; the first was the post-war era, the second was at the turn of the millennium," Lynch says. "Now, construction has major challenges with capacity and productivity. The government, to their credit, has encouraged offsite, with a presumption in favour. The Department for Education (DfE) has taken a lead, with offsite-only frameworks."

Cost, time and quality certainty

Clients are warming to the cost, time and quality certainty that offsite offers, says Lynch. McAvoy's Lynch Hill Enterprise Academy in Slough, an 8,759 sq m project, was delivered 17 weeks ahead of programme in 53 weeks, using 146 modules. At Dublin Airport, the firm delivered a 2,200 sq m passenger boarding area in just 16 days, craning in 77 steel-framed modules with an impressive 19m span.

McAvoy works in the health, education, residential, commercial and infrastructure sectors, and on frameworks for the DfE, NHS and Crown Commercial Service.

Lynch made the switch from supplier to principal contractor after concluding that tier 1s "wanted a project return that didn't reflect the value we brought to the project". Acting as manufacturer and contractor means dovetailing two different mindsets, which is where Lowry comes in. He joined McAvoy in April, after seven years at construction product giant CRH, and was previously managing director of main contractor Farrans.

"Every site has different challenges – utilities, environmental, multiple stakeholders – and the skill sets of traditional construction are well set up to manage them," Lowry notes.

"Those skills are not in someone from a manufacturer background. But they do understand we're delivering a product for the customer or end user, not simply a building.

"So we have to marry the two. We tend to employ people who have been principal contractors but can understand both sides of the business. They must understand the financial model of the business; once we reach site, the building has to go up very quickly while maintaining quality and safety protocols.

"People with flexible or agile minds fit well. But some from a traditional contracting background tend to regard our factory as a subcontractor. They are used to working through long programmes and passing risk down the supply chain. Understanding they have responsibility for the factory too is essential."

Lowry will become a fellow of the CIOB by November and recognises that it's a "valuable recognition of skills such as programme and project management". But he feels construction qualifications at professional and university level could "do more" to acknowledge the role of modular.

Not least because the product itself is becoming far more sophisticated.

"Compared to a decade ago, when it was essentially a shell, the value of the module is now four times greater, as we do more work in the factory," says Lynch. Modules now typically come with doors, windows, ironmongery, internal walls, plumbing, electrics and joinery. Smart sensors will be next, he adds.

The drive is to increase standardisation. McAvoy has collaborated with modular rival Elliott on the Innovate UK-backed consortium Seismic which also involves architect Bryden Wood. This has reduced the number of parts per module by up to 30%, to around 1,900 components.

"The initiative also addresses a customer concern that if one manufacturer goes bust, how do they finish a project," says Lynch. "It's never happened in our sector, but clients are worried since Carillion's collapse. So, with Seismic, we have a universal connection solution and a standardised structural frame for school buildings built offsite which both Elliott and McAvoy understand."

Seismic also launched an open source app to streamline the preconstruction phase, allowing architect, manufacturer, client and end user to input into the design of a primary school building in full compliance with DfE requirements.

With standardisation come quality and safety improvements, says Lynch. "The regime gives confidence, because of repeatable execution of tasks by the same people on multiple projects," he says.

"If we can increase that standardisation, and if the offsite market grows, then there are huge efficiencies and productivity gains," says Lynch. "Rather than us using hundreds of the same component we are talking tens of thousands."

Focus on standardisation

McAvoy will remain chiefly a modular business, says Lynch, though it will be involved in "hybrid" projects.

"Our Slough school project was an in-situ concrete core and steel superstructure, where we employed the frame subcontractors, with the modules comprising 65% of the project," he says. "If the client wants a sport hall, we can manufacture the panels, which leaves the roof as the main challenge. It's up to our structural engineers to work that out and we currently have one in design stage."

"But it has to be what's right for the business," adds Lowry. "And actually, we should be focusing on volume and standardisation, because only with high repeatability will we achieve the returns we want."

McAvoy uses the Build Offsite Property Assurance Scheme (BOPAS), which Lynch says addresses any perceived concerns and risks for purchasers. "With many new entrants to the market, we worry that others could damage the sector's reputation," he adds.

The company also works with trade body Build Offsite to promote the sector. Residential is a growth area and McAvoy unveiled a prototype house, BOPAS-certified, last November. The 95 sq m home is constructed in four steel-framed modules and two pre-tiled roof units.

McAvoy is also planning a new factory in England – in addition to its two plants in Dungannon and Lisburn – capable of delivering 1,000 new homes a year by 2023, which will double manufacturing capacity overall to 300,000 sq ft (27,871 sq m).

"Offsite is only five to 10% of the industry – and it won't be the answer for all buildings – but if we can grow the cake even a few percentage points, that means big opportunities," Lynch says.

How digital drives McAvoy's strategy

The group uses BIM and VR to ensure projects meet client requirements before manufacturing.

McAvoy became BIM Level 2 accredited in 2016 and digital adoption has been key to winning over clients.

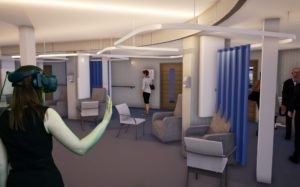

Increasingly, use of virtual reality (VR) engages customers with the asset and reassures them about its compatibility with end user requirements, says manufacturing director David Clark.

"On our Dublin Airport project, the client was concerned about the ceiling being too low in the passenger boarding area, even after viewing 3D flythroughs," he explains. "So then we gave them the VR demonstration using our headsets, and their concerns disappeared.

"VR also helped them with the spatial layout, and allowed them to make design changes, such as the position of the seating."

McAvoy's VR capability is demonstrated by Lorraine McMorrow, BIM and digital construction manager and a qualified architect, on a modular office block McAvoy is building for Homes England in Northstowe, Cambridgeshire.

"We are using a federated model, which brings together the steelwork, services, architectural and civil engineering models, which are all open file formats with common standards – this is a key requirement of our BIM strategy," she explains. "I brought all those models into one federated model in 15 minutes."

"We run clash detection and coordination, and look at any asset information, such as the maintainable M&E assets – the DfE are very keen on that."

Then the model is used to show clients around. "We can zoom down to the foundations and into the plumbing and services, but these are only 3D screenshots – VR offers something else again."

Wearing the VR headset, it is possible to look at all the different models within the federated model, for instance, viewing the structure only. "That's really useful for our construction managers," says McMorrow.

End users can view different interior finishing options, and the lighting at different times of day. "Teachers like to know where the sun will be during lessons, for example," says McMorrow.

"The aim is to build everything digitally and review virtually before we go to the manufacturing stage," says Clark. "The output will be 2D drawings and data which we give to our supply chain. We work closely with them to ensure we're giving them the right information. With our steel provider BW Industries, for instance, we can pass them data from our BIM model that goes straight into their CNC machines for steel fabrication."

Lynch says McAvoy is meeting with robotics manufacturers to bring automation into the factory but needs greater standardisation and volume to make it economical. "We're talking years rather than months, but the technology is moving very quickly," he says.

To date, McAvoy has only delivered one fully BIM Level 2 compliant project, but that reflects the industry's slow progress, says Clark: "These projects have to be delivered using COBie data, but the issue is that the client is not always asking for it."